If you’re wondering “How much child support will I pay in New Jersey?,” then this article is for you. It will show you how to calculate child support yourself so you better understand why you pay the amount of child support you do.

Every child support case is different. Unlike alimony, however, child support is calculated pursuant to guidelines. Typically, the most important facts that go into the guidelines (or “worksheets”) are the number and age of the children, each parent’s income, the amount of annual overnights each parent spends with the children, and health care expenses.

Obviously every family is different. In some cases there are adjustments for things like government benefits received or if a child has special recurring and predictable needs. Moreover, if you mediate or negotiate your case, instead of going to court, you may agree to an amount other than what the guidelines say.

Therefore, take this article for what it’s worth – which is a simple example of what child support would be based on a specific set of facts (outlined below). This article does not constitute legal advice, and it may not accurately calculate what child support would be in your case. I strongly encourage you to consult with an divorce lawyer to discuss your case if you want to get a better idea of what your child support will be.

Where to Find New Jersey Child Support Guidelines, Worksheets, and Laws

Each child support calculation is done on a specific worksheet, called a “child support worksheet.” Depending on how many overnights the parents have determines whether one should use a “sole parenting worksheet” or “shared parenting worksheet.” Once you have an understanding of how to use the worksheet, you can calculate child support yourself to estimate what child support in your case.

The New Jersey Judiciary website is a great place to find the New Jersey court rules about child support. Specifically, a lot of New Jersey child support laws can be found in Appendix IX of the court rules, accessible here: https://www.judiciary.state.nj.us/csguide/. Read through Appendix IX before you try to follow this article through a sample child support calculation.

How Is Child Support Calculated In NJ?

I believe the best way to understand something is to experience it. Therefore I will walk you through a step-by-step analysis of how to use a NJ child support worksheet. Understand, though, that as a law clerk I had two full days of child support training learning how to create these worksheets. I also had countless cases in court calculating child support on a case by case basis for a judge. It’s not easy.

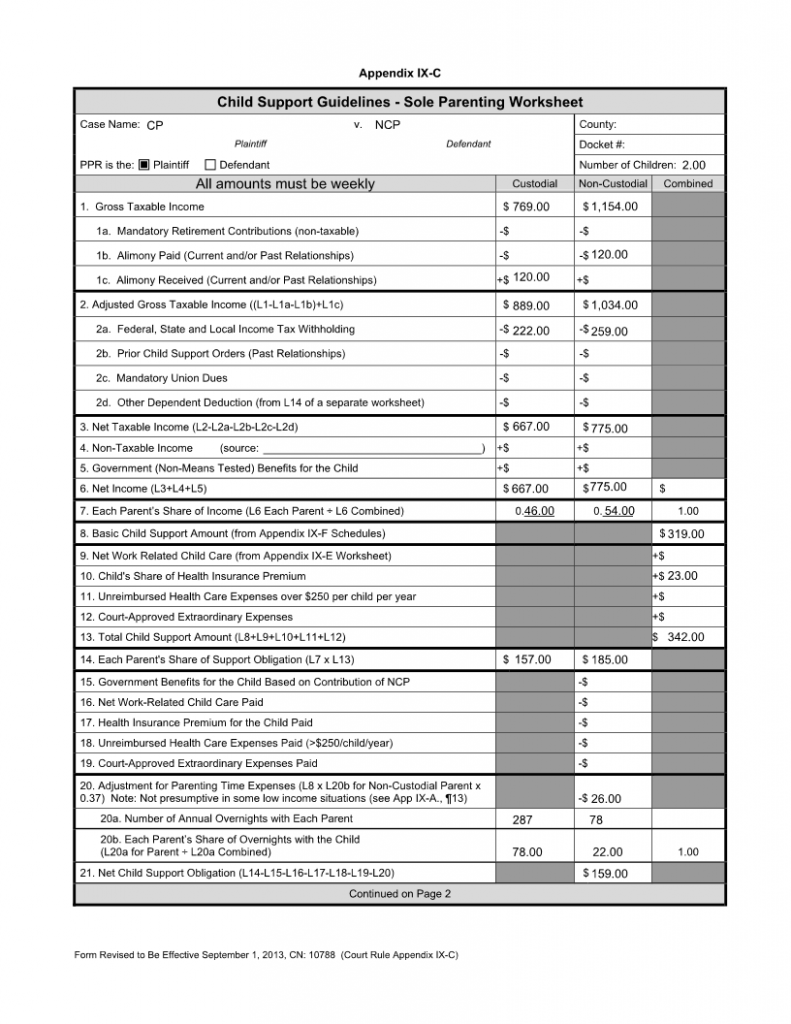

For our sample case, we will use the New Jersey sole parenting worksheet which you can access in Appendix IX-C of the Court Rules, found here: https://www.judiciary.state.nj.us/csguide/ix-c.pdf. **It is important to know that the worksheet is intended to be used in weekly amounts. We will use a simple set of facts that I have made up.

FACTS: We will assume that the parties have two children ages 5 and 9. The custodial parent (“CP”) earns $40,000.00 per year, and the non-custodial parent (“NCP”) earns $60,000.00 per year. They have no other income. The NCP has parenting time every other weekend, as well every other Wednesday (for a total of 76 overnights per year). We will assume that NCP pays CP $120.00 per week in alimony. We will also assume that neither party pays union dues or mandatory retirement contributions. We will assume CP pays $100.00 per month for the children’s health insurance. For tax purposes, we will assume each party’s withholding is 25% of their income.

Pull up the worksheet from Appendix IX-C, linked above, and fill it out as you follow along.

Line 1. Line 1 identifies the party’s gross taxable income. CP makes $40,000.00 per year, or $769.00 per week (remember everything must be broken down into weekly amounts). So in the custodial line 1, enter $769.00. NCP earns $60,000.00 per year, or $1,154.00 per week. So enter $1,154.00 under non-custodial line 1.

We said that NCP pays $120.00 per week in alimony, so enter $120.00 in line 1b for NCP. Since CP receives $120.00 per week in alimony, enter $120.00 in line 1c for CP.

Line 2. Line two shows each parent’s adjusted gross taxable income. Add the numbers in line 1 to calculate Adjusted Gross Taxable Income (AGI). CP’s AGI is $889.00 ($769.00 +$120.00) and NCP’s is $1,034.00 ($1,154.00 – $120.00).

In lines 2a through 2d, we will deduct certain expenses like income tax withholdings, prior child support orders, mandatory union dues, and other dependent deductions. For purposes of simplicity, we assumed above that each party withholds 25% of their incomes for taxes. This reduces CP’s weekly income by $222.00 ($889.00 x 0.25), and NCP’s income by $259.00 ($1,034.00 x 0.25). (You will need to review actual pay stubs and tax returns to find this information. The 25% figure is a completely random percentage for purposes of this example.)

Line 3 through 6. Line three shows each parent’s Net Taxable Income. For purposes of our example, this is AGI minus the income tax withholding. Assuming neither party has other income or government benefits for the child, then subtract the line items from section 2a – 2c from line 2 to reach net income. In our example, CP’s net weekly income is $667.00 and NCP’s net weekly income is $775.00.

Line 7. Next we figure out each parent’s percentage share of income. In this case, the parents’ combined incomes is $667.00 + $775.00 (remember, we do everything in weekly amounts), which equals $1,442.00. Therefore, CP’s % of income is 46% ($667.00 / $1,442.00). NCP’s percentage of income is 54% ($775.00 / $1,442.00).

Line 8. In line 8, you will need to reference Appendix IX-F of the Court Rules, found here: https://www.njcourts.gov/attorneys/assets/rules/app9f.pdf **I am unaware whether the website has the most updated figures so do not rely on this for accuracy. However, I will use that chart to show you how Appendix IX-F would work in our sample case.

In our case, we will be using the column labeled “Two Children.” Next, we follow the first column down to where the parents’ combined income is. We said above that the combined income is $1,442.00 per week. Therefore, go down column 1 until you reach the number $1,450.00. Then follow that row over to the column for two children. You will see that the child support amount is $319.00 per week. Enter that number in Line 8 of the worksheet.

Lines 10 through 12. We said above that the children’s share of health insurance is $100.00 per month, which we will round to $23.00 per week. We’ll also assume that no other changes will be made for any other expenses that would otherwise be contained in lines 9 through 12. Therefore, enter $23.00 in the appropriate box.

Line 13. Here you add the numbers contained in lines 8 through 12. In our case, the total amount comes to $342.00, which is the basic child support amount plus the cost for the health insurance premium. Enter this number in line 13.

Line 14. Line fourteen calculates how much of the total child support amount each parent should pay. To calculate this, we multiply the total child support amount (line 13) by each parent’s percentage of income. For CP, it is 46% x $342.00, which equals $157.00 per week. For NCP, it is 54% x $342.00, which equals $185.00 per week. Enter those numbers in the appropriate boxes. . I’ve skipped lines 16 through 19, because under our sample case these calculations don’t apply.

Line 20. Next go to line 20a. Under our facts, we assume that NCP has two overnights every other weekend (52 overnights), plus one Wednesday every other week (26 overnights), totaling 78 overnights per year for NCP. This means that CP has 287 overnights. Enter those numbers in line 20a. Percentage-wise, this breaks down to 78% for CP and 22% for NCP. Those percentages go in line 20b.

Line 20 Continued. Next we need to make the adjustment for parenting time expenses. The reason for making the adjustment is complicated. It has to do with accounting for variable expenses that a parent incurs during parenting time, which is about 37% of the child support obligation. To better understand the adjustment, read about it here: https://www.njcourts.gov/attorneys/assets/rules/app9b.pdf

To calculate for the adjustment multiply the following: total basic child support amount ($319.00, found in line 8) x NCP’s percentage of overnights (0.22, found in line 20b) x 0.37. This sum is $26 ($319 x 0,22 x 0.37).

Line 21. On line 21 we are calculating NCP’s net child support obligation. In many cases, this will ultimately be the final child support obligation. To calculate net child support, subtract the adjustments in lines 16 through 20 from NCP’s share of the child support obligation. In our example, this is $185.00 (line 14) – $26.00 (line 20), which equals $159.00. Enter this in line 21.

Line 27. For simplicity I am not making adjustments for other dependent deductions. Other dependent deductions apply in cases where a parent has a child from a different relationship. Therefore, the final child support order in this sample case is $159.00 per week. This is how much NCP would pay CP.

NJ Child Support Calculator

I hope you found this exercise useful. To calculate child support in your own case, follow the same steps as this sample article, substituting the facts of your case to the facts of the sample case. Again, you may have certain facts of your case that change the process or require adjustments, so do not rely on this article for accuracy or advice. Furthermore, most family law professionals have software that easily does these calculations for you, and probably more accurately. So it pays to meet with an attorney to review your case.

If you have any questions about your own child support case, please do not hesitate to schedule a free consultation with me. I’d be happy to review your case with you in person.

Sample NJ Child Support Guidelines

Sample New Jersey Child Support Worksheet

My passion for family law stems from when I was a law clerk to the Honorable Teresa A. Kondrup Coyle, the most experienced family law judge presently sitting on the bench in the Superior Court of New Jersey, Monmouth County. During my tenure with Judge Coyle I read through and analyzed hundreds of lawsuits between divorced couples. I watched the stress and trauma caused by trials and litigation. I saw what worked, what didn’t, and developed an unmatched understanding of how cases are decided by judges in Court.

I continue to hone my knowledge of my practice areas through memberships in several professional organizations, including the New Jersey State Bar Association, the Ocean-Monmouth Family Law American Inns of Court, Monmouth Bar Association, the New Jersey Association of Professional Mediators, and more. In addition to being a licensed New Jersey attorney, I have received Certification from the New Jersey Association of Professional Mediators’ 40-hour divorce mediation program.

Armed with both practical family law experience and specialized knowledge, I’m confident that I can help you and your loved ones resolve your family law issue. I realize that these sensitive matters require exploring all your options and carefully selecting a legal professional whom you can trust to move your case forward with compassion and diligence.